Introduction

The GLS approach to linear regression requires that we know the value of the correlation coefficient ρ. Unfortunately, usually, we don’t know the value of ρ, although we can try to estimate it from sample values. Since we are using an estimate of ρ, the approach used is known as the feasible generalized least squares (FGLS) or estimated generalized least squares (EGLS).

Extreme values of ρ

Let’s first look at a couple of extreme cases for ρ. If there is no autocorrelation, then ρ = 0, and so we can use the standard OLS regression. If ρ = 1, then the generalized difference equation takes the form

Δyi = β1Δxi1 + ⋅⋅⋅ + βikΔxik + δi

where Δyi = yi – yi-1, Δxij = xij – xi-1,j, and δi = εi – εi-1 Note that there is no intercept coefficient; i.e. we use regression through the origin.

This transformation may be a reasonable estimate when the first-order autocorrelation coefficient is high, say ρ > .8, or the Durbin-Watson d is low. A rule-of-thumb is that this form may be used when d < R2, where R2 is the coefficient of determination calculated using OLS regression on the original sample values.

Using the Durbin-Watson coefficient

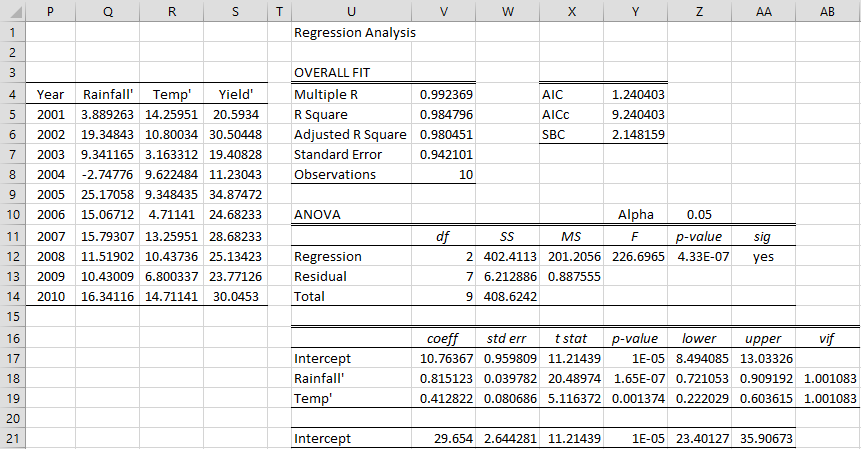

The sample autocorrelation coefficient r is the correlation between the sample estimates of the residuals e1, e2, …, en-1 and e2, e3, …, en. Since E[ei] = 0 (even if there is autocorrelation), it follows that

Actually, in the case of autocorrelation, we will use the slightly modified definition

Note that the Durbin-Watson coefficient can be expressed as

and so

d ≈ 2(1 – r)

Thus, we can estimate ρ by r ≈ 1 – d/2.

Example

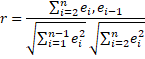

Example 1: Use the FGLS approach to correct the autocorrelation in Example 1 of Durbin-Watson Test (the data and calculation of residuals and Durbin-Watson’s d are repeated in Figure 1).

Figure 1 – Estimating ρ from Durbin-Watson d

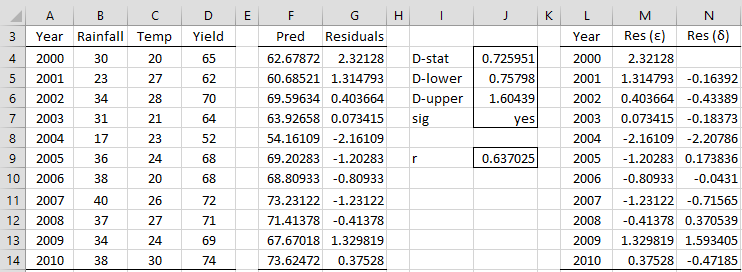

We estimate ρ from the sample correlation r (cell J9) using the formula =1-J4/2. The δ residuals are shown in column N. E.g. δ2 (cell N5) is calculated by the formula =M5-M4*J$9. We see from Figure 2 that, as expected, the δ are more random than the ε residuals since presumably the autocorrelation has been eliminated or at least reduced.

Figure 2 – Comparison of the residuals

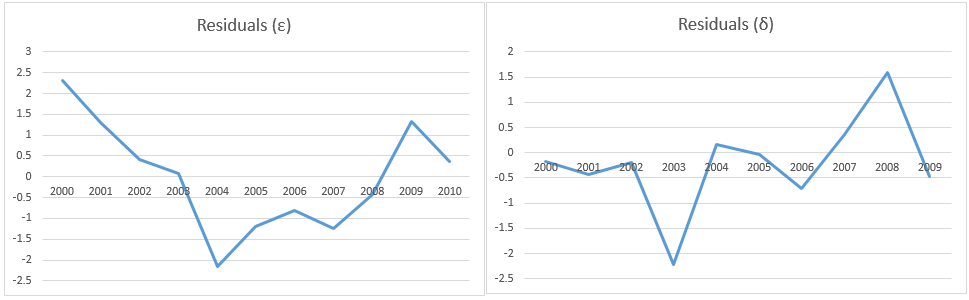

We now calculate the generalized difference equation as defined in GLS Method for Addressing Autocorrelation.

and ρ = .637 as calculated in Figure 1. This form of OLS regression is shown in Figure 3.

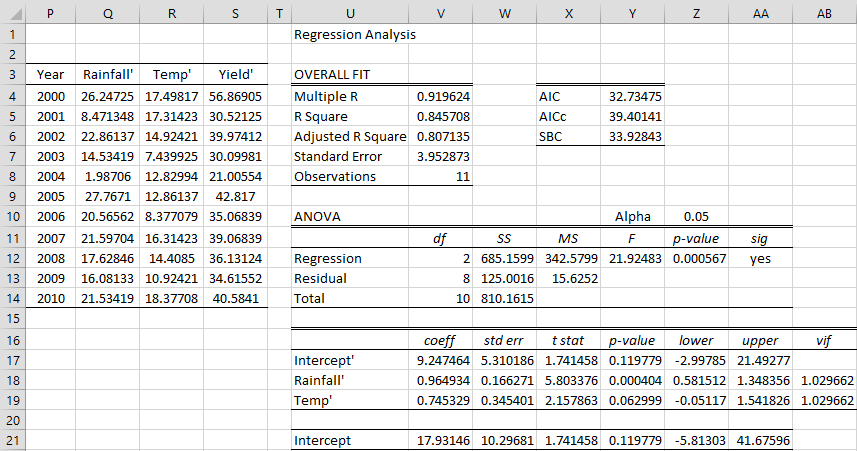

Figure 3 – FGLS regression using Durbin-Watson to estimate ρ

We place the formula =B5-$J$9*B4 in cell Q5, highlight the range Q5:S14, and press Ctrl-R and Ctrl-D to fill in the rest of the values in columns Q, R, and S. We now perform linear regression using Q3:R14 as the X range and S3:S14 as the Y range. The result is shown on the right side of Figure 3.

.8151 (cell V18) is the regression coefficient for Rainfall′ but also for Rainfall, and .4128 (cell V19) is the regression coefficient for Temp′ and also for Temp. The Intercept coefficient has to be modified, as shown in cell V21 using the formula =V17/(1-J9).

Note that the three regression coefficients (29.654, .8151, .4128) are a little different from the regression coefficients (30.058, .7663, .4815) calculated by the original OLS regression (calculation not shown). Similarly, the standard errors of the FGLS regression coefficients are 2.644, .0398, .0807 instead of the OLS values 3.785, .0683, .1427.

Observations

The FGLS standard errors are generally higher than the originally calculated OLS standard errors, although this is not always the case, as we can see from this example.

If had used the Prais-Winsten transformation for 2000, then we would have obtained regression coefficients 16.347, .9853, .7878 and standard errors of 10.558, .1633, .3271. This time the standard errors would have been larger than the original OLS standard errors.

Although the results with and without the estimate for 2000 are quite different, this is probably due to the small sample, and won’t always be the case.

Using linear regression

We can also estimate ρ by using the linear regression model

εi = ρεi-1 + δi

which is implemented using the sample residuals ei to find an estimate for ρ using OLS regression.

Example

Example 2: Repeat Example 1 using the linear regression approach.

This time we perform linear regression without an intercept using H5:H14 as the X range and G5:G14 as the Y range. The slope parameter .4843 (cell K17) serves as the estimate of ρ.

Figure 4 – Estimating ρ via linear regression

From this point on, we proceed as in Example 1, as shown in Figure 5.

Figure 5 – FGLS regression including Prais-Winsten estimate

This time, we show the calculations using the Prais-Winsten transformation for the year 2000. The Rainfall′ for 2000 (cell Q4) is calculated by the formula =B4*SQRT(1-$K$17^2). Highlighting the range Q4:S4 and pressing Ctrl-R fills in the other values for 2000.

If no estimate for 2000 were used then the regression coefficients would be 29.124, .8107, .4441 with standard errors 2.715, .0430, .0888.

Observations

There is also an iterative version of the linear regression FGLS approach called Cochrane-Orcutt regression. See Cochrane-Orcutt Regression for more details

Until now we have assumed first-order autocorrelation, which is defined by what is called a first-order autoregressive AR(1) process, namely

εi = ρεi-1 + δi

The linear regression methods described above (both the iterative and non-iterative versions) can also be applied to p-order autoregressive AR(p) processes, namely

εi = ρ1εi-1 + ⋅⋅⋅ + ρpεi–p + δi

Examples Workbook

Click here to download the Excel workbook with the examples described on this webpage.

References

Wooldridge, J. M. (2013) Introductory econometrics, a modern approach (5th Ed). Cengage Learning

https://faculty.cengage.com/works/9781337558860

Wikipedia (2018) Generalized least squares

https://en.wikipedia.org/wiki/Generalized_least_squares

Wikipedia (2018) Winsten estimation

https://en.wikipedia.org/wiki/Prais%E2%80%93Winsten_estimation

Thanks Kevin ,

I now understand the modified constant term .Its the inverse.

The other question I had refers to the Prais- Winsten estimate . Should J9 ( rho) be squared ? If you google the PW estimate the formula has rho squared. Also the same in my textbook.

cheers

Paul

Hello Paul,

I now see what you were referring to. The formula in cell S4 should be =B4*SQRT(1-$K$17^2).

I have now corrected this on the website.

Charles

Hi , should the Prais-Winsten estimate have p squared or J9 squared

Also should The Intercept coefficient to be modified, as shown in cell V21 using the formula =V17/(1-J9), instead be V17 *(1-J9)

Hello Paul,

Can you give me a reference to support the changes that you are proposing?

Charles

Paul, I had the same question. But I think I figured it out. Charles, is this right?

The equation after figure 2 for B’0 is

B’0 = B0(1-p)

yet the formula in figure 5 for cell V21 is V17/(1-J9).

This is consistent because in figure 5, cell V17 is B’0, and cell V21 is B0, so

B0 = B’0/(1-p) is the same as

V21=V17/(1-J9)

Hi Kevin,

Yes, you are correct.

Charles