Basic Concepts

Another non-linear regression model is the power regression model, which is based on the following equation:

y = αxβ

Taking the natural log (see Exponentials and Logs) of both sides of the equation, we have the following equivalent equation:

ln y = ln α + β ln x

This equation has the form of a linear regression model (where I have added an error term ε):

y′ = α′ + βx′ + ε

Log-log regression

A model of the form ln y = β ln x + δ is referred to as a log-log regression model. Since if this equation holds, we have

it follows that any such model can be expressed as a power regression model of form y = αxβ by setting α = eδ.

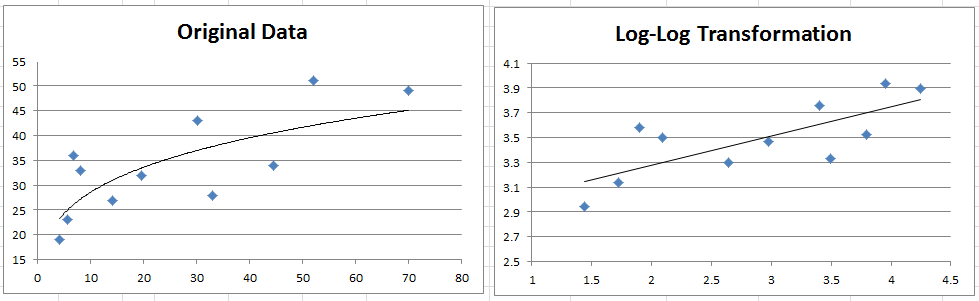

Example 1: Determine whether the data on the left side of Figure 1 is a good fit for a power model.

Figure 1 – Data for Example 1 and log-log transformation

The table on the right side of Figure 1 shows y transformed into ln y and x transformed into ln x. We now use the Regression data analysis tool to model the relationship between ln y and ln x.

Figure 2 – Log-log regression model for Example 1

Figure 2 shows that the model is a good fit and the relationship between ln x and ln y is given by

ln y = 2.81 + .234 ln x

Applying e to both sides of the equation yields

![]()

Scatter chart and trendlines

We can also see the relationship between x and y by creating a scatter chart for the original data and choosing Layout > Analysis|Trendline in Excel and then selecting the Power Trendline option (after choosing More Trendline Options). We can also create a chart showing the relationship between ln x and ln y and use Linear Trendline to show the linear regression line (see Figure 3).

Figure 3 – Trend lines for Example 1

As usual, we can use the formula described above for prediction. For example, if we want the y value corresponding to x = 26, using the above model we get

Excel Formulas

Excel doesn’t provide functions like TREND/GROWTH (nor LINEST/LOGEST) for power/log-log regression, but we can use the TREND formula as follows:

=EXP(TREND(LN(B6:B16),LN(A6:A16),LN(26)))

to get the same result.

Thus the equivalent of the array formula GROWTH(R1, R2, R3) for log-log regression is =EXP(TREND(LN(R1), LN(R2), LN(R3))).

Log transformations

In the case where there is one independent variable x, there are four ways of making a log transformation, namely

level-level regression: y = βx + α

log-level regression: ln y = βx + α

level-log regression: y = β ln x + α

log-log regression: ln y = β ln x + α

We dealt with the first of these in ordinary linear regression (no log transformation). The second is described in Exponential Regression and the fourth is power regression as described on this webpage. We haven’t studied the level-log regression, but it too can be analyzed using techniques similar to those described here.

Examples Workbook

Click here to download the Excel workbook with the examples described on this webpage.

References

R-bloggers (2022) How to calculate power regression in R (step-by-step guide)

https://www.r-bloggers.com/2022/02/how-to-calculate-power-regression-in-r-step-by-step-guide/

Libre Texts (2024) Nonlinear regression

https://math.libretexts.org/Workbench/Numerical_Methods_with_Applications_(Kaw)/6%3A_Regression/6.04%3A_Nonlinear_Regression

Geeks for Geeks (2024) Non-linear regression with examples

https://www.geeksforgeeks.org/non-linear-regression-examples-ml/

QUESTION:

I have a Power Regression Equation K=0.001P^2.38. The unit of P Ohm metre and that of K is metre/day. Is a valid equation given that the units are not the same on both sides?

Justine,

I don’t see any problem with that. Once you take the log of both sides, the units will be the log of those units.

Charles

Hi! I have a question. From your example, after determining that the data on the left of the table is a good fit for a power model (i.e. higher R^2 value, low significance F or p-value at alpha = 0.05, etc.), how can I determine if my predictive model (using power law fitting) is a good model using let’s say F-test? Similar to your example, I have an actual value of x and y (call it y_actual) as the independent and dependent variables, respectively. I determined that with these variables, power law fitting is a good fit. I used the determined coefficients to calculate for the corresponding predicted values of y (call it y_calc) using the same set of x variables. What kind of F-test should I do to validate that my predictive model is a good model from the actual/original model?

Hello Nicolas,

If by power law you mean the transformation described on this webpage, then the resulting model is a linear regression model, and so you can use any of the approaches used for linear regression, namely R-square, F test or RMSE. See also

https://www.theanalysisfactor.com/assessing-the-fit-of-regression-models/

Charles

I Need to perform Power regression Y=aX^b and we have more than one independent variables let say x1, x2,x3 ; now I try to perform log transformation and want to check combined effect of x1,x2,and x3 independent variables against dependent variable Y . my question is which data have to be taken for analysis whether multiply (x1*x2*x3) or any other alternative means of analysis where independent variables are more than one and two and combined effect of this variables against dependent variables

Amsalu E

With two independent variables, you can use Y=a*X1^b*X2^c. This results in the linear regression ln(Y) = ln(a) + ln(X1)*b + ln(X2)*c. If you also want to take interactions into account, then you can use Y=a*X1^b*X2^c*(X1*X2)^d. This results in the linear regression ln(Y) = ln(a) + ln(X1)*b + ln(X2)*c + ln(X1*X2)*d, which is equivalent to ln(Y) = ln(a) + ln(X1)*b + ln(X2)*c + ln(X1)*d+ln(X2)*d, which is equivalent to ln(Y) = ln(a) + ln(X1)*(b+d) + ln(X2)*(c+d). This can be extended to three independent variables.

Charles

ok Thanks is there any assumptions that should be considered before start to analysis using power regression

Just the usual assumptions for linear regression.

Charles

Hello, what do I do if I have a known exponent? I’m trying to model up a power regression for sediment transportation. Thank you

Does this mean that you have a polynomial? In this case, see

Polynomial Regression

Charles

Hello

Y=aX^b + C, is that a power model equation where Y and X are not log transformed ? If the power b is 1 or more than 1 what does it explain about the relation between Y and X?

Thank you for your reply in advance.

Regards

Zahirul

Hello Zahirul,

1. Y=aX^b is a power model. Adding the C means that you can’t use a log transformation.

2. If b=1 then you have a linear relationship between Y and X. If b>1 then you don’t have a linear relationship. E.g. if b=2 then you have a quadratic relationship.

Charles

Hi Charles,

The equation I am working with is y = ax^b. How do I calculate the confidence interval of b?

Many thanks,

Laura

Hi Laura,

As explained on this webpage, this equation is equivalent to lny = lna + b*lnx, which is of the form Y = A + b*X where Y=lny, A = lna and X = lnx. This is a linear regression equation. The output from this regression contains the confidence interval for each of the coefficients, i.e. the A coefficient and the b coefficient.

Charles

Charles,

I would welcome your help with a data set issue that I have.

If you have a moment, an email would be very much appreciated.

Many thanks.

John,

Yes, you can send me an email.

Charles

Thank you.

email sent – hopefully it hasn’t got stuck in any Junk filters.

John,

I have not received any emails from you today.

Charles

Re-sent at 2122hrs

To: czaiontz at gmail and

info at real-statistics

John,

I have not received an email from this email address. Did you use a different email address?

Charles

hello Charles,

my model is y=a*x^b*z^c where y=f(x, z) ..how can I derive the equations that used to estimate the constants (a, b, and c) using the linearization theory of multiple power models and multiple linear regression theory??

help me

thank you so much

Take the natural log of both sides of the equation yo get

ln y = ln a + b ln x + c ln z

This is a linear equation with independent variables ln x and ln z, constant ln a and dependent variable ln y

Charles

I would like to thank you for your modesty and your patience first .. I know that I have to convert the equation into a linear equation but my question was how did I find the equation that represents the constants a, b, c.

The solution that I did is at the bottom, But I stopped when I wanted to find the formula for the constant c . If the equation was(y=a*x^b), the solution would have been like this:

log(y) = log(ax^b) = log(a) + log( x^b)

log(y)=(log a)+b(log x)

and Y=log( y) , A=log( a) , X=log( x)

so Y=A+bX (linear model)

and use liner regression to find A ,b

A=Y ̅- b x̅

Y ̅=(∑Yi)/n where n=number of independent variables

x̅=(∑Xi)/n

A=log(a) = 〖log_10 〗a → a=10A

And b=(n ∑Xi Yi- ∑Yi ∑Xi)/(n ∑Xi^2- (∑Xi)²)

Thus we found the values of the constants (a) and (b)

But if the equation is with this model (y=a*x^b*z^c), How will we find the values of a, b, and c ? Will the equation for finding a and b remain as above, or will they change !! How do I find the formula for the value of c!

I desperately need to solve this model (y = a * x ^ b * z ^ c) and find its equations .. many thanks and affection.. i wish you true happiness.

Regards.

y = a * x ^ b * z ^ c becomes

log(y) = log(a) + b * log(x) + c * log(z)

Now, let y’ = log(y), a’ = log(a), x’ = log)x) and z’ = log(z).

Thus, the equation becomes the linear equation y’ = b * x’ + c * z’ + a’

If (x, z, y) is one of the data elements, you use (log(x), log(z), log(y)) as a data element for the linear equation regression model.

Using these, you can estimate the coefficients b, c and a’ using OLS linear regression.

To find a, you not that a’ = log(a) and so a = e^(a’), assuming that all the log are base e. If base 10, then a = 10^(a’).

Charles

How to plot log(y) = log(a) + b * log(x) + c * log(z) this equation in excel to get constants a,b and c?

You have two choices.

(1) Treat it as a non-linear equation. You can use Solver to find the values of a, b, c that minimize the sum of squared errors (SSE). This is the approach that is used on the website to find the coefficients for exponential regression

(2) Treat it as a linear regression problem of the form Y = A + bX + cZ. Use then use the data for log(y) for Y, the data for log(x) for X and the data for log(z) for Z. This will yield the values of the coefficients A, b, c. The coefficient a can be found by setting a = Exp(A).

Charles

Hello Charles,

could you possibly help me transform y = x^a to linear form. And how to calculate a from it?

I was given an example that y = 1 / (1 + exp(ax) does the job but i cannot figure out how?

Thanks in advance!

Hello Damian,

Is “a” a fixed constant or a regression coefficient?

In any case, the equation y = 1 / (1 + exp(ax) looks like the form of a logistic regression equation. Is this what you are looking for?

Charles

Yeah “a” is a regression coefficient. After further enquiry I deducted that y = x^a and y = 1 / (1+exp(ax)) are different examples. I need to find a linear “version” of the latter could you help me with that? I cannot find anywhere on the Internet how to tackle this.

In addition to finding a linear version which I believe only the ax part can be “linearized”. I need to compute a formula to get value a from that. I am not quite sure how would i do that.

Hi Damian,

I don’t know of a linear version. This looks more like a logistic regression equation.

Charles

Hello,

What about if we have multiple predictors?

For example if we have y function of x1 and x2 while a,b,c and are regression coefficients

y = a + b*(x1)^c + d*(x2)^e

can this equation be transformed to a linear equation?

Hello Ahmed,

If you replace the + by * (y = a * b*(x1)^c * d*(x2)^e) then it can be transformed into a linear equation. Otherwise no.

Charles

Is it possible to add a third independent variable to this model? As in x3? If yes, what is the final form of the model.

Jol,

Do you mean y = ax1^b1*x2^b2*x3^b3 ? If so, take the log of both sides to obtain ln y = ln a + b1 * ln x1 + b2 * ln x2 + b3 * ln x3. This is a multiple linear regression model.

Charles

What is the threshold for value of alpha and beta?

Alpha must be positive (otherwise log of alpha is not defined). There are no requirements for beta.

Charles

Dear charles,

Is it possible that on an set of data like in your example in excel you can get only upper 95% confidence line and it’s equation?

Yes

I got it at very critical and very important time.

thanks for sharing it.

Hi Charles!

Thx a lot for this post, if its the opposite I want to know the x value from the function, how could I do that?

Ken,

It really depends on what you mean, but if y = a*x^b then y/a = x^b, and so x = (y/a)^(1/b).

Charles

Thank you very much. This helped me a lot.

Dear Charles,

Can you please help me with the equation y=(1+a*x)^b ?

Joe,

I assume that you want to transform this equation into a linear regression model.

If you take the log of both sides of the equation, you get ln(y) = b*ln(1+ax), which is y’ = b*x’ where y’ = ln(y) and x’ = ln(1+ax).

Charles

Hi, Thank you for your complete explanation.

My questions is:

I we have a data set and we are going to use an power correlation to predict the data set. How can we determine the SEE of our correlation? Can we transform the power correlation to a linear correlation and then calculate the R square and SSE as a goodness of our fit? Because i think the calculated SSE for power and transformed correlation (linear correlation) would not be the same.

Thanks in advance for your help.

Meysam,

If I understand your question correctly, then let me say the following. The linear transformation gives an approximation of the results and so you can use R square and SSE as for linear regression. You can also use nonlinear regression. This is all explained in the case of exponential regression. See

Exponential Regression.

Charles

Hi,

I have multiple graphs showing the standard deviation of mean wind speed against mean wind speed. One such dataset yields a power curve with the relationship y=0.1349x^0.9719. I’m struggling to understand what this is telling me about the relationship. I know from the trendline that the relationship is very linear but could you explain to me what sort of relationship the s.d has against mean and can I work out a ratio from this as in if mean wind speed increases by 1 m/s the s.d will increase by x%.

I’ve had no luck finding a clear answer on the internet.

Good day Charles and many thanks for a job well-done.

I carried out some turning experiments where I recorded cutting forces (3 variable for each experimental run). I’m trying to use multiple regression analysis to predict the lives of the cutting tools used for the experiment. How do I go about this please. Your help will be highly appreciated please.

Muhammad,

You can start by looking at the Multiple Regression part of the website.

Charles

Hi Charles, I understand finding confidence intervals for a linear regression. It’s great and very helpful. Now to apply the same steps on a power fitting curve (y = a*x^b) , I used a log transformation to make it linear (log(y)=log(a)+blog(x)). In this case the Standard error is in a logarithmic format, I think. How do I find the confidence intervals?

Following a linear regression method where 90% conf. Interval = Standered error (Se)* t_test (at 90%)/ sqrt(n) where n is number of observation, I get a very small value for conf. interval. I’m expecting a couple of thousand. I can tell that Se is too tiny and that is the reason. even when I transform the value from the log format by raising it to the power of 10.

Appreciate your help

Regards

Bahaa

Bahaa,

Figure 2 of the referenced webpage gives an example of the confidence interval in the log-log case.

In any case, if you use natural logs, then if the confidence interval for linear case is [h, k], then when you go back to the original x and y values, the confidence interval will become [e^h, e^k]. If you use log base 10, then the confidence interval will be [10^h, 10^k].

Charles

Hi Charles, I greatly appreciate your help and response.

Here is my problem:

For the same set of data (n=6), I run a- linear curve & b- Power curve which I transformed to log-log so I can run excel data analysis to get Standard error (Se) then Confidence Intervals.

a- gave Se = 1981.8; upper 90% confidence Interval (the delta to be added to the point estimate to get 90% confidence level) = 1724.8.

b- log-log curve: gave Se = 0.054, (MS_res = 0.003), 90% confidence level, = 0.0476. Transform back to actual value = 10^0.0476 = 0.987. This is not realistic. I should get a value close to what I got in case a.

How I get the Se for a power regression curve? or how I extract it or converted from the log-log curve?

Appreciate you patience and help. actually I can send you the data points and the associated statistics.

Bahaa

Bahaa,

In my last response I thought that you were trying to calculate a 90% confidence interval for the slope parameter. I see now that this is probably not what you had in mind since you are referencing MS_res. You are looking for the 90% confidence interval of which statistic?

How did you calculate the confidence level of 0.0476 from the standard error of 0.054?

Charles

Hi Charles, thank you again for your time.

The linear model: y = 0.0527x = 6483.5. Using excel data package to run the regression, I got:

Regression Statistics

Multiple R 0.957743143

R Square 0.917271929

Adjusted R Square 0.896589911

Standard Error 1981.81279

Observations 6

ANOVA

df SS MS F Significance F

Regression 1 174192899.6 174192899.6 44.3511816 0.002640735

Residual 4 15710327.74 3927581.934

Total 5 189903227.3

Coefficients Standard Error t Stat P-value Lower 95%

Intercept 6483.508814 1073.583844 6.03912666 0.003791086 3502.762205

x 0.052749098 0.00792068 6.65966828 0.002640735 0.030757766

from which:

n = 6; DF = 4; Se = 1981.8.

t_stat @ 90% CI= TINV(0.1,DF) = 2.13

90% CI = Se * t_stat/SQRT(n) = 1724.8. this formula I got from some online research.

b- Using Power curve: y = 56.706*x^0.4747

In order to use Excel data analysis, I transformed it to log-log curve: log(y) =log(56.706) + 0.4747 * log(x)

Excel output similar to the above linear curve produced:

n = 6; DF = 4; Se = 0.0547.

t_stat @ 90% CI= TINV(0.1,DF) = 2.13

90% CI = Se * t_stat/SQRT(n) = 0.047

transform back from Log so

90% CI = 10^0.047 = 1.11. This is my problem. I expect 90% CI to be close to the 1724.8 resulted from the linear curve above.

The 90% CI is the boudn around the single point estimate in my case.

I hope I could explain my problem more clearly.

Thank you

Bahaa

Bahaa,

The formula for the CI is se * t_stat. You don’t need to divide by SQRT(n). se = sd / SQRT(n) where sd = standard deviation.

Charles

Hi Charles,

I used this method for a project at work and got estimates for a and β. so now that I have the estimate for y being y=ax^β I want to put a confidence interval around y.

I can obtain a confidence interval for both a and β, but I am not sure what error propagation technique to use to get a confidence interval for y.

Any help would be greatly appreciated!

Thanks,

Stephen

Ok, I think I need to clarify this a bit.

Using the above example I can get the s.e. of a=exp(2.813)*.206 and I can get the s.e. of β=exp(.234)*.068

How do I combine the s.e. of a and the s.e. of β to get the s.e. of y?

Stephen,

You don’t calculate the standard error of y this way. Instead the s.e. is equal to the square root of MSE. This is explained after Figure 5 of the following webpage: https://real-statistics.com/multiple-regression/multiple-regression-analysis/multiple-regression-analysis-excel/

Charles

Thanks for the response! That was definitely helpful but I am still kind of stuck…

In your example under figure 3 you get the formula for estimating x when x=26 as y = 35.748.

It makes sense how we get there but I am confused on how to get a confidence interval around y = 35.748 — and also for any other y given x.

Hopefully that makes sense. Thanks for all of the help!!

Stephen,

Essentially a “power” regression is a transformation of variables to obtain an ordinary linear regression model. For an ordinary linear regression model you can obtain confidence or prediction intervals as described on the following webpage:

https://real-statistics.com/regression/confidence-and-prediction-intervals/

You just need to perform the inverse transformation on the end points of this interval to obtain (an estimate of) the interval that you are looking for.

Charles

Hi Charles,

I got the formula for the Confidence Interval & Prediction Interval from:

https://www.youtube.com/watch?v=_ZgWScL3F-A

It states that the difference between the 2 is that PI = CI * SQRT(n).

But even when I don’t devide by the SQRT(n), the resulted CI is unrealistically small.

Thank you for your response and time

Bahaa

Charles,

To make it easier to interpret the coefficients and predicting, what equation would you use in the example I provided for the ln model vs log model?

I posted the regression outcome of the same data set taking the ln of y and x’s and log of y and x’s.

Finally, I wondered if the log log coefficients represented % changes. So, a +1%y= x%.

Joe,

In comparing a ln model with a log model, note that ln(x) = log(x)/log(e). Thus these models are identical except for a constant multiplier.

Charles

Charles,

Love this blog, awesome info!

Question, I’m trying to create a price elasticity model that has other variables (multiple regression) that come into play. When I log or ln transform the y and x’s, both have great fits. My problem is using either set of coefficients to predict. I may be doing it right, but I want to be sure.

LN model

Intercept = -6.4

Discount % = .198

Ad % = .843

Log model

Intercept = .03349

Discount % = .013558

Ad % = .133

How would you deal with these to predict?

Thanks!!!’

Joe,

For ordinary linear regression you can do prediction using the TREND function as explained on one of the following webpages:

https://real-statistics.com/regression/regression-analysis/

https://real-statistics.com/multiple-regression/multiple-regression-analysis/multiple-regression-analysis-excel/

For any value of x (or x’s) this yields a forecasted (or predicted value of y). Now if you have transformed both y and x using LN, then you need to reverse the process using exp to get the forecasted value you want.

E.g. Suppose your original equal is y = ax^b. This becomes ln y = b * ln x + ln a, which can be modeled via linear regression. For any given value x0 of x the regression model will provide a forecast of ln y for ln x0 (using the TREND function). Say this forecasted value is z0. then exp(z0) would be the forecasted value you are looking for. E.g. suppose that x0 = 2 and so ln x0 is .693. Now suppose that the forecasted value for .693 from you log-log linear regression model is .2, then the forecast for x0 = 2 should be exp(.2) = 1.22.

Also see the following webpage:

https://real-statistics.com/multiple-regression/multiple-regression-log-transformations/

Charles

Charles,

Thank you for the quick reply! I want to make sure I’m understanding what you mean using my example above. If my discount % was 10 and ad % was 80, to predict the LN version I would say y = exp(-6.4)*(10^.198)*(80^.843)? How would I deal with the log version? I’ve seen it should be interpreted as for 1% change in y the coefficients represent the % change ie in my log example -1.3 would be the elasticity (at 10% discount) since a 1% change in discount = 1.3% change in demand.

Sorry Joe, but I don’t understand where you get the expression y = exp(-6.4)*(10^.198)*(80^.843). I also don’t understand your question about how to deal with the LN version.

Charles

Hi,

I run cut tests on various materials and input the force used to cut and the distance moved by the blade to cut through the material into a spreadsheet. The old method of assessing the data was to represent the data graphically and then compare different trend line types to see which “looked” the best. The force required to cut through at 20 mm can then be determined and the material categorised.

I am trying to reduce the amount of human error by using just the equations to determine the best kind of trend line for the data. I am no mathematician and am using the R^2 of the trend lines to determine which trend line is best.

Can you help me with formulas that will give me the R^2 for each trend line type without having to actually produce the graph each time?

Thanks!

James,

See the following webpage for how to calculate R^2

Regression analysis in Excel

Charles

That’s great, thanks!

Hi Charles,

Wonderfully informative site I’ve discovered here. I’m asking for advice on a series of straightforward length-mass regressions. I’m using a power model to develop a series of predictive equations. I can find the SE of both the slope and intercept quite easily using log x, log y transformation and LINEST function in Excel. Yet, I really require the SE of slope and intercept for the power model. Any advice on an approach? Is it appropriate to use the log-log approach and simply “back-transform” the SE values I produce for a and b? Thanks so much for your work on the site!

Yes, this is a reasonable approach.

Charles

Thanks for the quick reply. Again, simply need SE of fitted constants a and b in the power model. The SE of the exponent b was simple. However, for one example, using the log-log approach to obtain estimates of a and its SE yielded -2.4253 and 0.1403. Using base 10 and exponent of -2.4253 returns my fitted constant of a = 0.0038 as in the power model. Great! Yet, using base 10 and exponent 0.1403 to obtain the associated SE returns 1.3815. The end result of a = 0.0038, SE 1.3815 for my power model does not seem reasonable to me (seeing similar results for my other regressions too). In all cases I have r2 > 0.94 and thus exceptionally “good” power and log-log models. As a beginner, I must be missing something…Thanks in advance for the assistance.

LTR,

You shouldn’t take the reverse translation of the standard error, but of the lower and upper ends of the confidence interval.

I understand for the log-log regression model (base 10) you have a = -2.4253 and se = 0.1403. Now assuming you have say n = 10 observations, and so df = n-2 = 8, then the lower end of the 95% confidence interval will be a + se * T.INV.2T(.05,8) = -2.4253-.1403*2.306 = -2.74883 and similarly the upper end is -2.10177.

You now need to take the anti-log base 10 of these values to get a’ = 10^(-2.4253) = .003756 and a confidence interval of (10^(-2.74883), 10^(-2.10177)) = (.001783, .007911).

There are other approaches, but this is the simplest. The same approach is used for the slope.

Charles

Hi Charles,

Thank you very much. I found it very helpful for me. I am trying to solve a similar kind of problem. I have an equation as follows.

Y=C*[(x1)^z1]*[(x2)^z2]*[(x3)^z3]*[(x4)^z4]*[(x5)^z5]

I want to find out the values of C, z1, z2, z3, z4 and z5.

It’s an experimental study. I can solve this problem, if I can take readings of Y, by varying one parameter (among x1, x2… x5) at a time, by maintaining other parameters constant.

But my x1 varies with a change in each other parameter.

First I can solve the following equation for finding C1 and z1 using the procedure you suggested.

Y=C1*[(x1)^z1]

So, from the second step onwards, at every step, I will have an equation as follows

Y=C2*[(x1)^z1]*[(x2)^z2]

in each stage, C2 varies among C2, C3, C4 and C5 and x2 varies among x2, x3, x4 and x5.

When apply LN on both sides, I am getting

ln Y = ln C2 + z1*ln x1 + z2*ln x2

Here, I noticed that z1*ln x1 is a known value, as I already calculated z1 value in step 1, but varies with each set of readings of x2 and Y.

But, I stuck here, I couldn’t go forward to solve this. Please help me.

Sorry, but I don’t completely understand the series of steps that you have outlined, but here is a possible approach. I understood that the step where you get stuck is ln Y = ln C2 + z1*ln x1 + z2*ln x2. Since z1*ln x1 is a known value, this reduces to the form ln y = C3 + z2*ln x2 where C3 = ln C2 + z1*ln x1. Thus you can use regression techniques to find the coefficients C3 and z2 in ln y = C3 + z2*ln x2. Once you know C3 you can solve for C2 using the equation C2 = exp(C3 – z1*ln x1).

Charles

z1*ln x1 is a known value but not a constant; it varies through out the series of readings. When I explaining you the problem, I got an idea. I modified the equation as follows.

ln Y – z1*ln x1 = ln C2 + z2*ln x2

Then the complete LHS has been treated as ln Y and done the regression. Then I got C2 and z2 values. Is this procedure correct?

I can explain my problem in detail with the following example.

x2 Y x1

2.5 22.8 0.689

3 23.6 0.689

3 24 1.379

3.5 24.4 2.068

4 24.8 4.482

5 25.2 6.551

5.5 25.4 8.96

5.5 26 24.13

6 26.4 34.827

6 27.2 45.172

now I calculated ln Y – z1*ln x1 for each row. Then this column has been treated as ln Y and done the regression. Tell me if this is wrong. Sorry if I couldn’t explain you well.

It should work as long as z1 is known.

Charles

Okay, thank you very much sir. You helped me a lot.

Thank you very much, that was very informing, but I am stuck with a similar problem (the herschel-bulkley fluid model); how do we solve a problem like this :

y = a + b*x^c

how can we determine a, b, and c?

Maamar,

If c is a positive integer, then you can use the approach described on the following webpage

https://real-statistics.com/multiple-regression/polynomial-regression/polynomial-regression-analysis-tool/

If c is not a positive integer, then you can use a non-linear regression approach which is similar to that explained on the following webpage

https://real-statistics.com/regression/exponential-regression-models/exponential-regression-using-solver/

Charles

Thank you very much Charles, that was very helpful!

I tried the solver method, and it worked.

again, thank you Charles.

Maamar

Hi Charles,

I am working with a similar model to Maamar, with slight differences: y=a-b*x^c

I have used excel solver to determine the values of a, b and c, and I now need to calculate the standard error of each parameter.

c is a positive non-integer in my case. Is there a way to do calculate the standard errors on excel?

Which of the a, b and c are constants and which are regression coefficients to be estimated from the (x,y) data?

Charles

Hello, any bibliographic reference that you recommend to me to study the whole theoretical framework of this regression model? Thank you!

Genaro,

Are you looking to understand the mathematics?

Charles

Hi Charles.

I am conducting research on metal fatigue and this regression model best describes the trend of experimental data. Hence my interest in knowing in depth the theoretical framework of it.

Thank you. Best regards!

Genaro,

I don’t know of any books related to the theoretical framework for metal fatigue. The theoretical framework that I am familiar with are mathematical in nature.

Charles

Charles

I think I did not explain myself well. I apologize for it. My interest is to know the theoretical framework of the potential regression, since this regression model applied to the experimental data obtained in tests of metal fatigue, allows to obtain a better approximation of the variability of the data.

For this reason the request of some bibliographical reference to know more about the potential regression.

Best regards!

Genaro,

There are hundreds of books which which give a theoretical background on regression, but I can’t identify any one book on the subject. The Real Statistics website also includes a lot of information on this topic.

Charles

Charles, you can correct me if I’m wrong, but I am trying to find the standard error of the coefficients and I think it requires an approximation for the intercept that is not shown in the Figure 2. Since we have α = exp(δ), the standard error of α can be calculated with Taylor approximation (https://en.wikipedia.org/wiki/Taylor_expansions_for_the_moments_of_functions_of_random_variables). This results in std(δ) ≈ exp(α) * std(α). So in your case, std(δ) ≈ exp(2.81) * 0.206 ?

Steven,

From Figure 2, we see that δ = ln α = 2.813 with s.e. for δ = .206. Also, as you say, α = exp(δ).

Using a Taylor series approximation, we find in general that if y = g(x), then var(g(x)) = (g'(x))^2 * var(x). This is called the delta method.

In this case g(x) = exp(x) and so g'(x) = exp(x). Thus, the s.e. of α = exp(2.813) * 0.206, which is what you wrote, although I think you mixed up std(δ) with std(α).

Charles

Charles

Hello Charles,

Can you please help me with my equation y=a*(b^x)*u.

Adela,

First take the log of both sides of the equation to get logy = loga + xlogb + logu. If I let y’ = logy, a’ = loga, b’ = logb and u’ = logu, I get the equation

y’ = a’ + b’x + u’

Assuming u is another independent variable, then this can be analyzed using multiple linear regression. If instead u is a constant, then let c = loga + logu, to get the simple linear regression model y’ = b’x + c.

Charles

Charles,

Sorry for my English, i will try to explain .

The model on wich I am working, has more or less the shape of the upper part of an aircraftwing.

I used your idea to find the curve from front to back. And the other axes in the model is of the type y=ax+b. These are the prominent dimensions.

I experienced the problem with Excel, that i could not bent the surface in an apropiate curve in one dimension since it is all lineair, like a flat sheet of metal which you can manipulate.

The result with ln(x) is that de model now has a curve, uses less varibeles, and predicts better.

Rene,

Yes, that is the idea behind using non-linear regression models such as y = b*ln(x) + a. The good news is that if you set z = ln(x) you have a linear model of form y = bz + a and so can use linear regression. You will get a slightly better model if you use a non-linear model, but the linear model usually works pretty well.

Charles

Charles,

Thank you very much, smart solution.

This is also my solution to the problem that Excel Multi Lineair Regression gives a flat plate. Where as there is variable in the collection which has a power function.

Rene,

Sorry, but I don’t understand your question.

Charles

Rene,

Sorry, but I don’t know what a “flat plate” means. I also don’t understand your second sentence. Do you mean, where is the data analysis tool for power regression? You can use the Linear Regression and/or Exponential Regression data analysis tools.

Charles

Hello Charles,

Thank you for your insights here.I happen to have a question on the power law; however, it seems to combine a number of statistical aspects.

I am looking to fit a line on the linear part of a log-log plot of a power law. Unfortunately with excel, the power trendline fitted automatically takes into account the entire data set. I need to ignore the outlying first part. I have tried to look for methods to solve this and somewhere I found a suggestion that to bin my data. Other suggestions were to use maximum likelihood estimation or weighted least squares.

I did try to use Linear regression but it did not help. The biggest problem is where to choose to begin the regression from; what point in the data set?

Do you have any tricks up your sleeve as regards this?

Musa,

Can’t you just restrict your analysis to those points that are on the subset of the curve that you are interested in?

Charles

the power of developed equation is attained when the predicted value are within the range of input data

hi Charles,

Firstly, sorry if my question is not related here. I know one of my IV have no relationship with the DV(corr= 0.07). But I still wanted to put in the equations even though the result of the parameter variable is not significant after regression. The adjusted R square is 0.76 and the whole equation can be trusted. (<0.05). What can I do with the no correlation variables that I want it? Can I transform the particular data? Thank you in advance.

Yuna,

If you want to retain some independent variable in the model for theoretical reasons (based on your domain knowledge), then just keep it in the model and don-t worry about the fact that it is not significant. If you instead want to use some transformation that yields a significant regression coefficient, then make that transformation (I would do this based on some theoretical, not statistical, basis).

Charles

Pheww thank you Charles. However, can we make transformation to the variables if its already no relationship with the DV? Ive tried some method on transformation but only slight changes. Still far from significant. Thank you again Charles.

Yuna,

Here is a an example where a transformation can make a big difference

x y

1 -0.002004008

2 0.001908397

3 1.70797E-05

4 9.54129E-07

5 1.02405E-07

6 1.65383E-08

7 3.54014E-09

The correlation coefficient is .14876. If you use the transformation y –> (1/y + 500)^.1 then the correlation coefficient will be 1.

I don’t know how useful this is, but at least it shows that a transformation can make a difference in the correlation coefficient.

Charles

thank you so much Charles. Wish you are given longevity of health so you can always be here helping us.

In model: ln y = β ln x + α

β is short term elasticity.

How to calculate long term elasticity? I think it is connected with:

ln y = β ln x + β1 ln yt-1 + α

Matija,

I think you are asking me a question about economics, not statistics. It looks like you are looking for a time series model of long term elasticity. The website explains how to model time series and create forecasts based on the resulting model. This part of the website is under construction, but there is already a lot of useful information in the site about this topic.

Charles

Hi,

Near the end of the page, you explained how to get an X, if you know the Y. You did it like this: =EXP(TREND(LN(B6:B16),LN(A6:A16),LN(26))).

Is there any way to find Y, when you know the X?

Thanks in advance,

Kevin

Kevin,

It depends on which power model you are referring to. For the log-log model, you simply perform regression of log x on log y, and so can you the same Excel formula, exchanging the roles of x and y.

Charles

Are you talking about this?

http://spreadsheetpage.com/index.php/tip/chart_trendline_formulas/

Power Trendline

Equation: y=c*x^b

c: =EXP(INDEX(LINEST(LN(y),LN(x),,),1,2))

b: =INDEX(LINEST(LN(y),LN(x),,),1)

x and y are the data set that you have to generate this formula.

Is it possible to transform a model that has both a power and a linear variable?

My formula is y=a*x^b+z*d, where a*x^b covers what can be considered fixed tasks with improvement over months of time (x) and z*d covers variable support tasks that will scale with the effort z in hours of the people being supported.

I’ve currently set it up using an addition column for y-hat and used solver to estimate a, b, and d by maximizing the r2. I’m rather pleased with the result, however I’m wondering if there’s a way to transform this for use with linest. Also, being that I’m not nor should I ever be considered a mathematician I wonder if there’s anything I’m missing that would cause my results to be in error.

Please note that I also performed multivariable linear and transformed power regressions using linest. The results between my model and the two variable linear model are somewhat close, I just have a conceptual issue with the linear model since it estimates the fixed tasks as being negative if you go far enough in the future. I appreciate any help you can provide.

Thanks,

Jason,

Sorry, but I don’t know any way to use a transformation so that linest can be used.

Charles

Jason,

I may have that same question too, i.e. one predictor variable (x) that has a power relationship with response y, and another predictor (d) that has a linear relationship with y, which I want both together run in same (linear) model.

Probably you can simply run such (linear) model by linearizing (log-transform) all but the d predictor variable:

ln y = ln a + b * ln x + z*d

But, please, anybody confirm that, or correct me if I am wrong.

Jason,

This model looks correct to me. You can address it as a linear model or a non-linear model (e.g. using Solver).

Charles

Hi Charles,

I just wanted some clarification on why do we use a linear trend-line for the log-log transformed data? If we used a power trend-line, would it be less accurate?

Thanks for your help,

Anna

Anna,

The idea of the log-log transformation is to get a linear relationship. For this reason after the transformation you check for a linear trend. For the data before making the transformation, you won’t see a linear relationship and so your would not use a linear trendline.

Charles